What is the software development market in Ukraine and should it be regulated?

The Ukrainian software development market ranks third in the country in terms of export while being second only to the food sector and metallurgy. The share of the software market is 26% of the export of services.

In 2016, the market increased tax revenues to the budget by 88%, which amounted to 7.1 billion hryvnas.

Probably, this is the reason why the government decided to pay attention to the regulation in this area. The Better Regulation Delivery Office (BRDO) established at the initiative of the Ministry of Economic Development and Trade has developed the so-called Green Paper on the regulation of this economy sector, which is so important for the country. Delo.UA tried to learn more about basic details and provisions of this document.

What is the software market?

Analysts divide the market into two main areas. The first one includes outsourcing companies and R&D centers, and the second one – start-ups and product-oriented companies. Such a division occurs due to the differences in building the business processes in these companies. The market is actually based on intellectual work. Therefore, one of the most important factors in the functioning of the sector is the stability of working conditions, including paying taxes. BRDO expert give accent to the possibility of importing from abroad prototypes of equipment, for which software is developed, and to the currency regulation when selling final products, including outside Ukraine, among other important factors affecting the market.

Enterprises specializing in IT outsourcing makes the largest share of the market.

This category includes the top 10 largest IT companies in Ukraine by the number of employees.

The development and research centers (R&D), which are actually divisions of large international companies in Ukraine, represent about 6% of the market. This segment differs from the first category in that they have the only customer – the parent company.

Photo: pixabay.com

Product-oriented companies and start-ups stand apart in the market. Their difference from outsourcers is that they do not sell services, but a finished product/stand-alone service. And it can be sold as many times as they see fit. “Such companies are the owners of intellectual property items,” the research states. Experts note that this category is rather conditional in our country. After all, Ukrainian start-ups often refer to those companies whose founders are from Ukraine. At the same time, many of them work under the jurisdiction of other countries.

Impact on other sectors

The IT industry has a significant impact on other sectors of the country’s economy. For example, according to the research center “The Economist Intelligence Unit”, in the USA, 2.5 million jobs in the software development market created 7.3 million jobs in other sectors. That is, one IT specialist can create 2.9 additional jobs.

In Ukraine, 100 thousand IT employees can potentially create 290 thousand jobs in other sectors.

The research indicates the real estate market as one of the bright examples of impact on other sectors. For example, the IT sector has been taking leading positions in terms of the demand for office real estate over the past four years. “In 2016, IT companies created 41% of demand, while the pharmaceutical industry ranked second with just 21%,” the BRDO gives interesting data.

Market volume

What is the volume of the Ukrainian software market? There is no single estimation. Most experts believe that developers producing software for foreign customers create 90% of the market. According to the BRDO Office, this situation occurs due to a small number of enterprises ready to buy comprehensive IT solutions in Ukraine. In addition, companies, which are leaders in the sector, practically are not involved in public procurements because of their small volumes as well as corruption and reputational risks.

As for the volumes, according to PwC, the volume of the Ukrainian software development market amounted to $3.2 billion in 2016.

At the same time, the State Statistics Service estimates that the export volume of computer services is $1.4 billion, and the National Bank – $2 billion. Experts call this significant difference in the estimation the State Statistics Service and the National Bank a negative trend, which indicates the need for using the more improved classification. Specialists believe that the PwC company’s estimation is the most accurate, as calculated on the basis of data provided by the companies themselves.

However, both the NBU, the State Statistics Service and PwC have a common opinion: the Ukrainian software development market has increased almost more than twofold since 2011. It continues to grow even after the crisis of 2013-14, while most of the sectors of economy experienced a decline. Since 2013, the growth of the software market has amounted to 58%. According to experts, there are 1,650 companies in the market and their number has increased by an average of 41% since 2012.

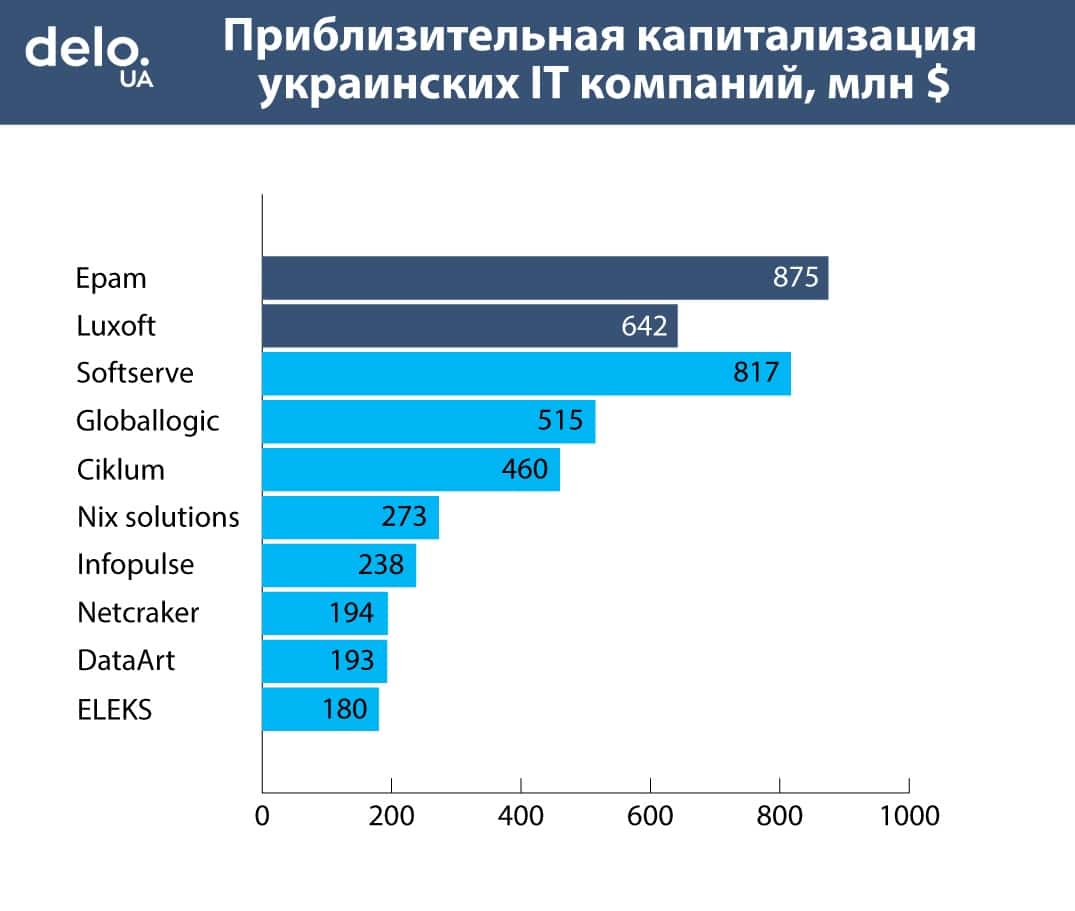

Capitalization of companies in the sector

Most companies of the sector are not public and accordingly do not disclose their financial performance. This, of course, complicates the assessment of capitalization. The shares of two largest international companies – EPAM and Luxoft – are in demand in the market, and experts estimated that the capitalization of their Ukrainian divisions is about $875 and $642 million respectively. For comparison, the capitalization of Raiffeisen Bank Aval is estimated at $617 million, Ukrnafta – $267 million and Motor Sich – at $199 million.

In general, the capitalization of the 10 largest IT companies exceeds $4 billion.

Workforce capacity of the sector

Estimation of the market volume by the number of employees varies from 87.5 thousand to 103.5 thousand people. The average annual increase in number of specialists employed in the sector is 15-20%. One-third of all employees work in TOP-25 largest companies in the sector.

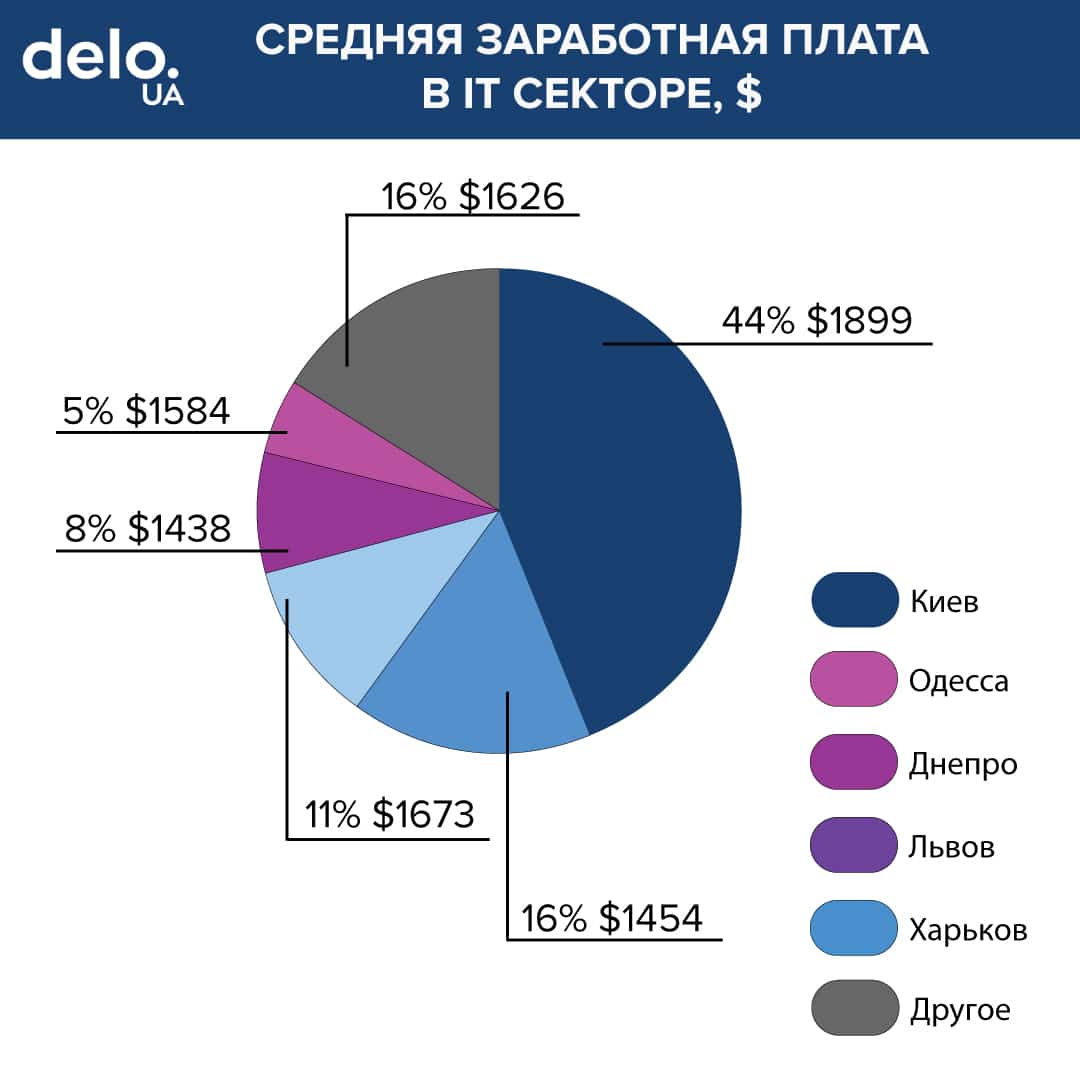

The interesting point is related to the geographical concentration of programmers. For example, according to researchers, less than half of the employees in the sector are concentrated in the capital, but only 13 of the TOP-50 companies are represented in Kiev.

At the same time, wages in the regions remain almost at the level of the capital. While the average wage of programmers in Kiev is $1,899, it is $1,673 in Lviv and $1454 in Kharkov. “Such geographical spread helps raising the standard of living and development of regions,” the research states.

Distribution of wages by region according to the BRDO’s research

According to the research, the average wage for novice programmers is $591. “This is almost 5 times higher than the minimum wage established by the state,” analysts note. However, the starting salary in the sector ($610) has even decreased since 2015. More experienced developers earn on average $1,700 in Ukraine.

The important factor in the market is also the high demand for specialists. As of mid-2017, more than 3 thousand vacancies were opened in the sector.

At the same time, this number has doubled since 2015.

Experts report about problems with incumbency rates and explain it with a number of factors. One of them is the outflow of graduates of IT specialties, which, according to different estimates, ranges from 25 to 35%. Another problem is the incompatibility of education with the market requirements and its long period. For example, today it takes 45 to 70 months to train one IT specialist. Experts believe that in case of updating training programs, this time can be reduced to 31-59 months.