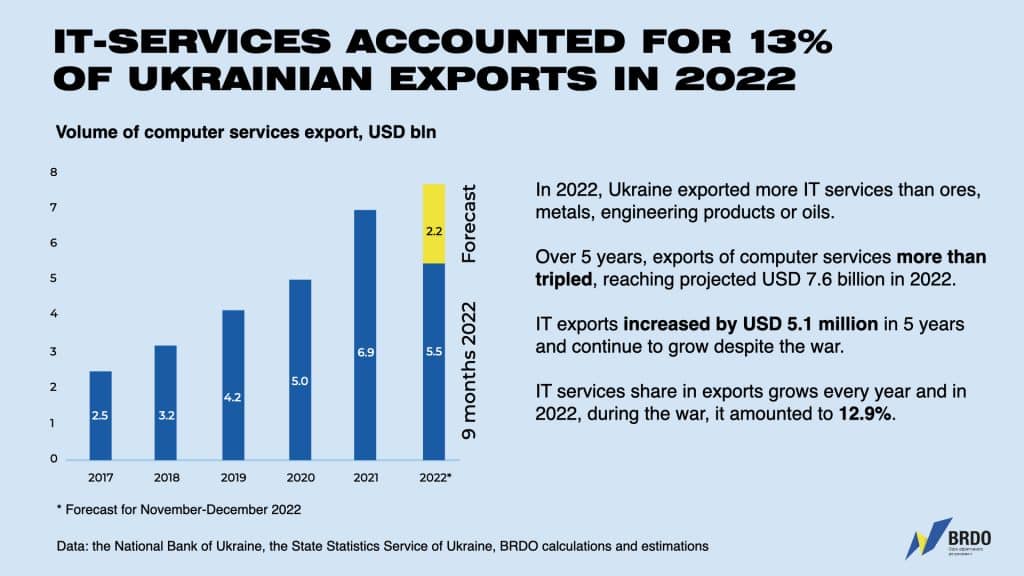

Even during the war, the export of IT services accounted for 13% of the total export of Ukraine in 2022. In general, our country exported more IT services than ores, metals, engineering products or oils. BRDO analysts decided to find out how the IT industry has changed in 5 years.

In 2017, the BRDO IT and Telecom sector team published the Green Paper “Software Development Market Regulation”, conducting public consultations in Kyiv and Lviv, as well as online, on industry development and government regulatory hurdles.

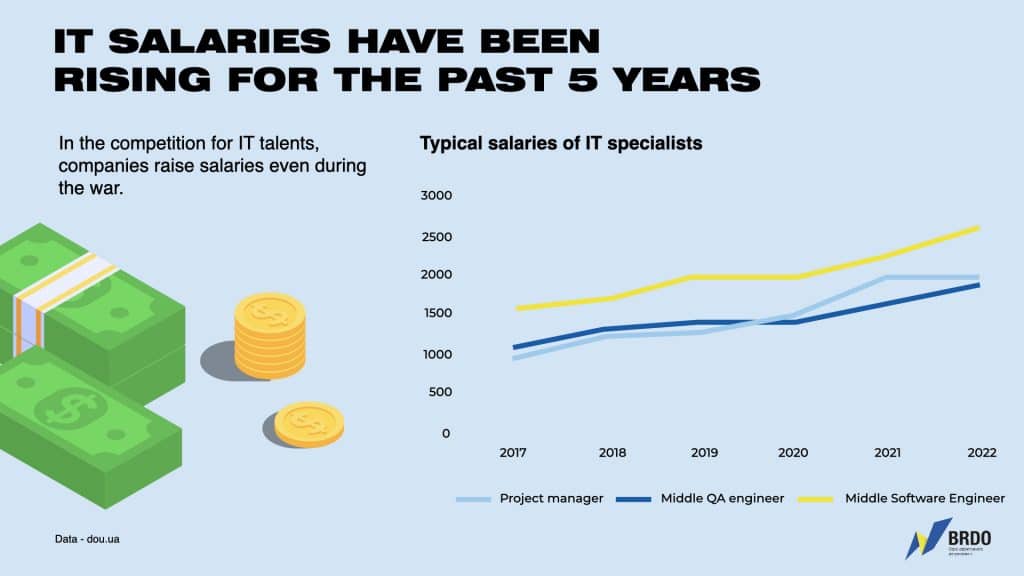

At that time, the export of software development services amounted to USD 3.2 billion (for 2016), which provided more than 4% of export revenues. The market provided about 100,000 high-paying jobs, where the salary of a beginner was 5 times higher than the minimum wage in Ukraine.

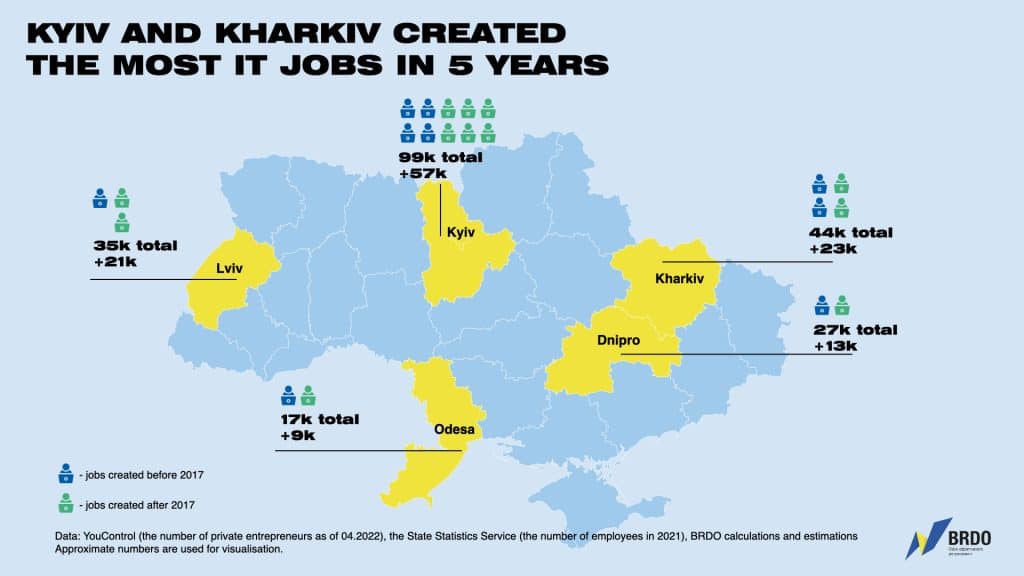

Kyiv, Kharkiv, and Lviv were the leaders among IT cities. At the same time, the high level of wages was maintained regardless of the city, which was a significant factor in regional development.

How has the IT industry changed in 5 years?

IT exports increased by USD 5.1 billion in 5 years and continues to grow despite the war. According to the forecast, in 2022 it will amount to USD 7.6 billion, which is three times higher than the figure of 2017.

The share of exports of IT services grows annually, and in 2022, despite the war, it was 12.9%.

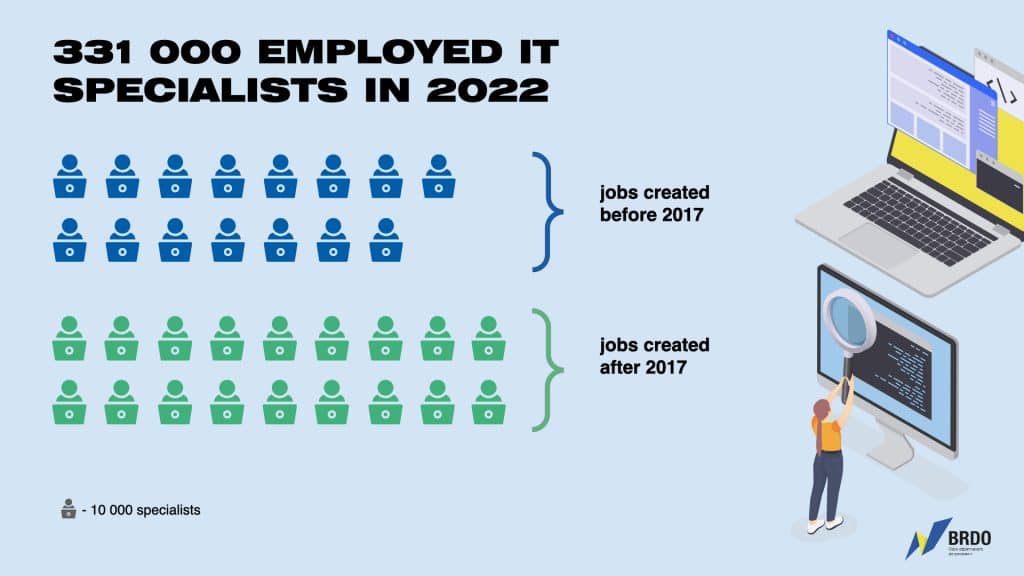

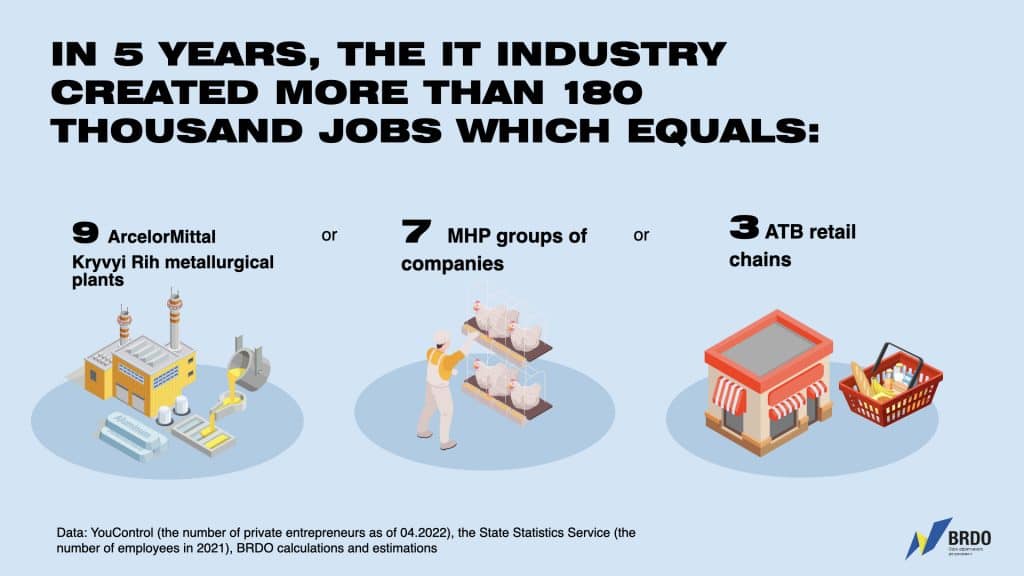

In 2022, 331,000 specialists work in the industry. Over 5 years, the IT industry has created more than 180,000 jobs. For comparison, this equals the number of jobs in 7 MHP groups of companies, or 9 metal plants of ArcelorMittal, or 3 chains of ATB stores.

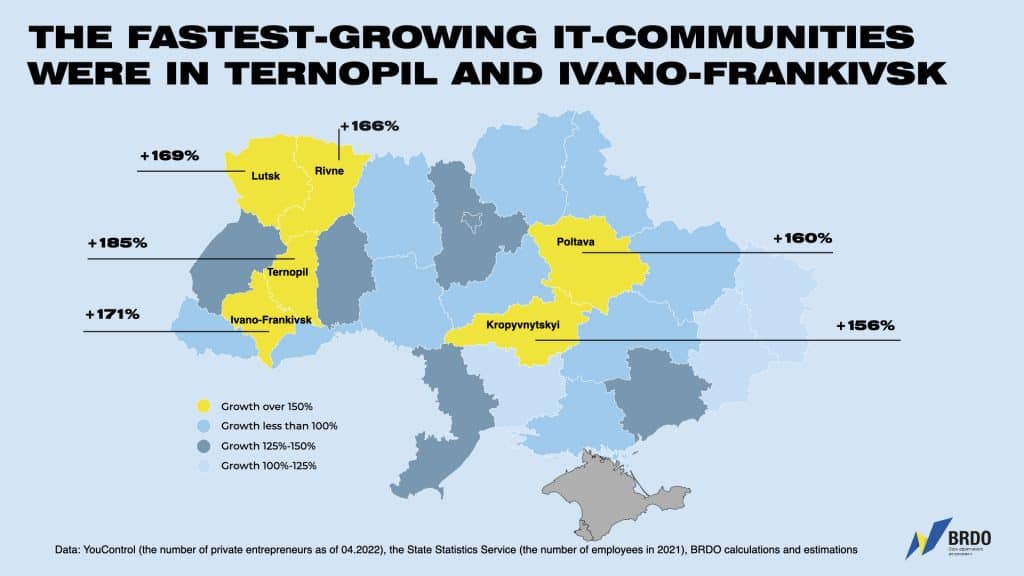

Kyiv, Kharkiv and Lviv continue to be leaders in the number of IT workers (99 000, 44 000 and 35 000 employees, respectively). Smaller regional IT communities are also growing rapidly. Thus, the fastest rates are shown by Ternopil and Ivano-Frankivsk – in these cities, the number of people employed in IT increased by 185% and 171%, respectively. The center of Ukraine is not far behind – Poltava and Kropyvnytskyi are also actively creating IT jobs (+160% and +156% in 5 years, respectively).

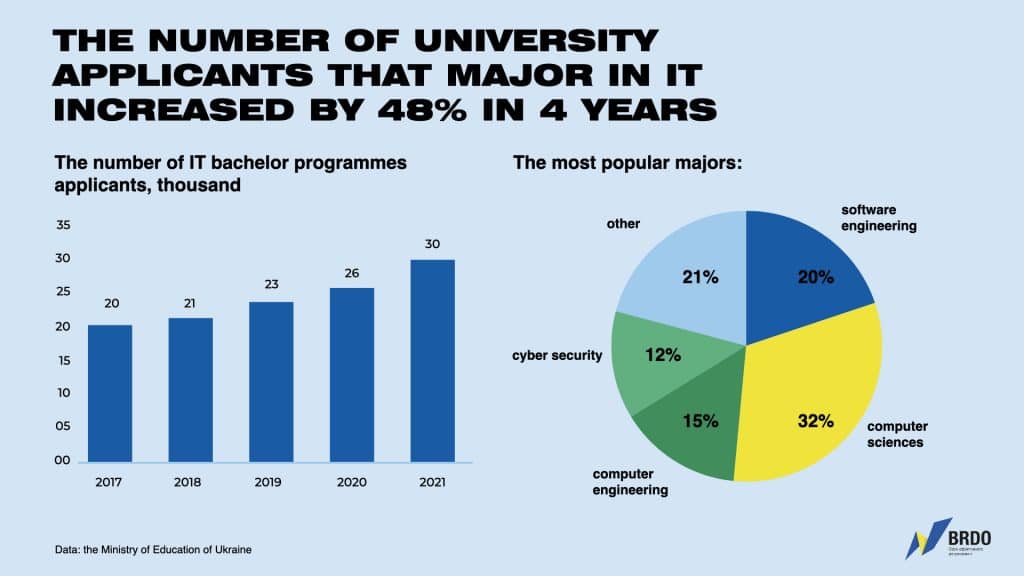

The popularity of the IT industry is also growing among university applicants. The number of bachelor programmes applicants to computer majors was 30 000 in 2021 and increased by 48% compared to 2017. The most popular majors are computer science, software engineering, computer engineering, and cyber security.

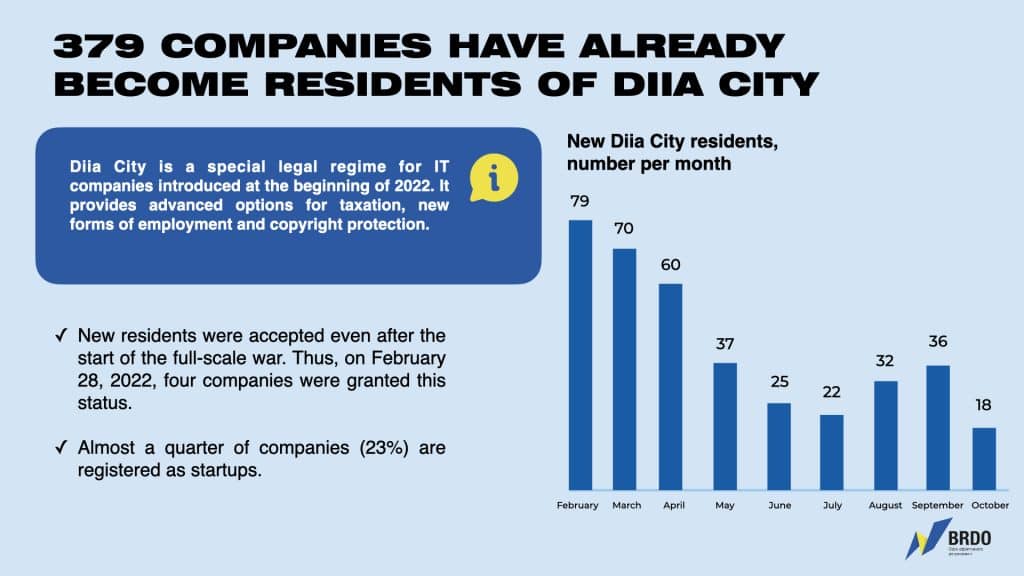

Even before the full-scale invasion, the Government of Ukraine created a special legal regime for IT companies called Diia City. It provides advanced options for taxation, forms of employment, and protection of copyright. Decision-making on residency continued even after the start of the full-scale war – on February 28, four days after the Russian full-scale invasion of Ukraine, four companies were granted this status. Currently, 379 companies are residents of Diia City.

“The Ukrainian IT industry has shown incredible growth in 5 years. Both from the point of view of exports and from the point of view of new jobs. Even during the war, the industry continues to grow. The IT industry became one of the main factors of Ukraine’s economic development and economic security during the war,” commented Ihor Samokhodskyi, head of the “IT and Telecom” sector of BRDO.

BRDO presentation on 5-year change in IT sector is available for download.

Disclaimer:

The estimate of the number of people employed in the industry is relevant for April 2022. For the evaluation, the number of active private entrepreneurs (PE) according to the defined codes of business activity (KVED) as of 04/08/2022 (the date of the last published set of the Single State Registry) and the number of employees of legal entities according to the defined KVEDs for 2021 were used (the latest data were published by the State Statistics Service of Ukraine).

The source of inaccuracies in such an estimate may be the following factors:

- obsolescence of data;

- departure of employees abroad without termination of PE status (according to DOU.ua, the share of vacancies abroad increased from 8% in January 2022 to 26% in April 2022);

- dismissal of employees without termination of PE status (according to DOU, the number of vacancies has approximately halved compared to 2021, and the number of job responses has doubled).

The following KVEDs were used for analysis: 58.21, 58.29, 62.01, 62.02, 62.03, 62.09, 63.11.

BRDO is grateful to YouControl for the kindly provided data.